Win More

Smart sellers rely on Winmo to close more deals with advertisers and agencies. Find your next client today.

Smart sellers rely on Winmo to close more deals with advertisers and agencies. Find your next client today.

Sales teams use Winmo to get actionable leads, alerts on who’s buying, and complete decision-maker lists of who controls top marketing budgets. It’s not just a database, it’s a second brain you need to own the leaderboard.

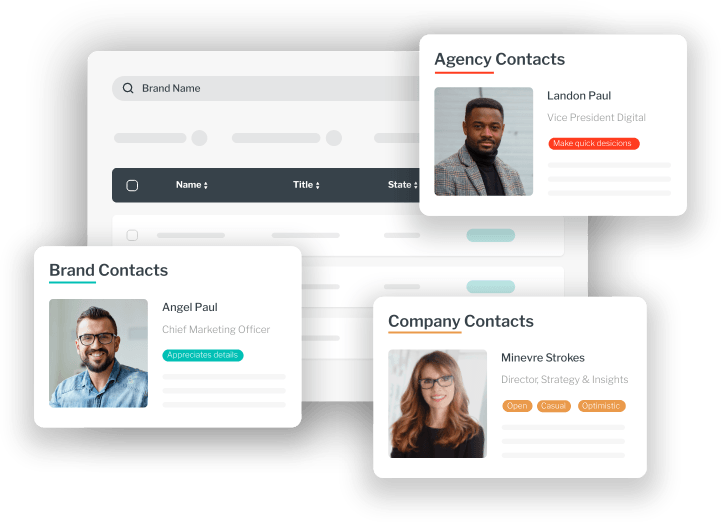

Who controls the budget you’re targeting – and how can you win them over? Winmo maps brand, corporate, and agency teams to the budgets they’re responsible for, and delivers contact details, priorities and personality traits to help you get their attention.

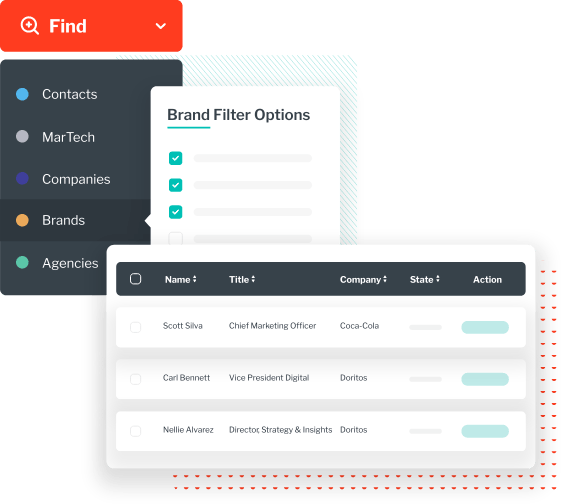

Sales teams use Winmo to identify companies buying what they’re selling. Whether that’s agencies handling specific client types, advertisers in a specific medium, or corporate sponsors catering to a key demographic, Winmo makes it possible to identify who should be on your target list.

What are your prospects’ pain points? We’ll help you learn about their strategies, struggles, and spending behaviors so you sound like the expert they’ve been waiting to hear from. Outreach tips that improve response rates threefold.

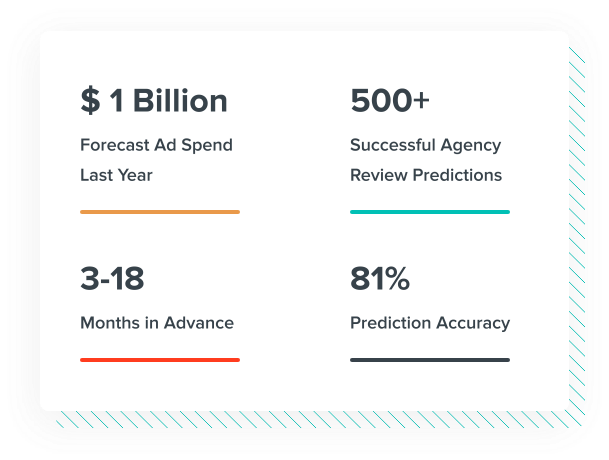

Winmo translates subtle shifts into actionable signals every morning, alerting users to imminent campaigns, agency hirings and partnership opportunities on the horizon. Instead of reactively chasing prospects after they make the news, Winmo customers have the unfair advantage of foresight.

It’s everything you need to increase sales in less time, with less effort.

Keep your sales prospecting pipeline full of quality leads. Whittle down thousands of national advertisers and agencies into a targeted list of sales prospects that are ideal for your offering.

Learn about sales opportunities weeks, months, and even a year in advance of your competition with our predictive sales leads on national advertisers and their agencies.

Instantly understand an advertiser’s budget, demographics, pain-points, and buying behavior with a wealth of insights that make you look like you’ve done hours of painstaking research.

Stop scouring trade publications and social feeds to try and keep up with the industry’s never-ending shifts. Our in-house lead generation research team has your back – making the calls, analyzing mountains of data, and predicting shifts. Make Winmo your unfair advantage.

Land new clients without relying on referrals and RFPs.

Rev up your sales prospecting by connecting with more brands and agencies.

Land more deals with major brands best fit for your technology.

Score business with brands that crave your exposure.

Kent was looking to connect with a Coca-Cola marketing director and Winmo gave him advice on how to communicate with that contact to yield the highest rate of success. See how we helped him.

Ready to see Winmo in action?

Get demo